The deferred COGS account is the new feature introduced in Release 12.

The key fundamental behind the feature is that the COGS is now directly

matched to the Revenue. In simple terms, this means, COGS for an order

line will be recognized only if the revenue is recognized for that line

making sure that the revenue and COGS are posted in the same month.

Matching percentage is also taken care which ensures that revenue and

cost are always in sync.

SETUP > Inventory Resp > Setup > Organization > Parameters > Other Accounts

Here Enter Deferred COGS Account

STEP:

==========

1. Create Sales Order and do Pick Confirm

2. Complete Shipping Confirm Process and run interface trip stop Program.

Below two Accounts Will hit.

Cr > Inventory Valuation accoun

Dr > Deferred COGS Accoun

Go To Inventory responsibility and Review the Accounts in Material Transactions form.

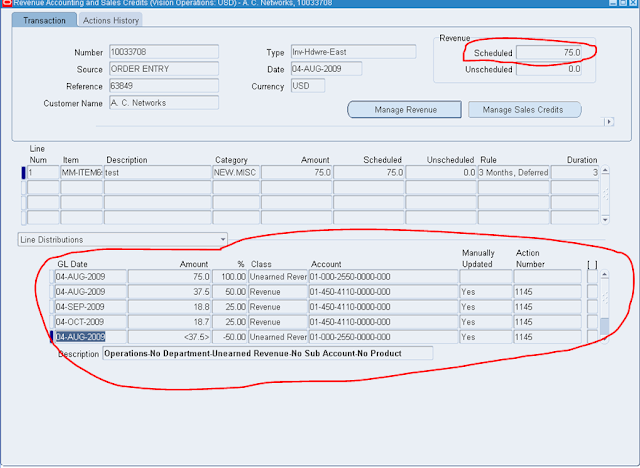

3. Run Workflow Background Process and AutoInvoice Master Program to Create Invoice in AR.

Now AR invoice Got Created, But Revenue not yet Recognized.

Go To AR Resp > Control > Accounting And Search with Sales Order Number.

Revenue Not Yet Recognized.

4. Recognize the revenue in AR.

NAV > Accounts Receivables Resp > Control > Run "Revenue Recognition" Program.

After running the program, again check for Revenue.

5. Now we have to accept the Revenue.

Click on "Manage Revenue".

6. Run Below Set Of Concurrent Programs.

Record Order Management Transactions: records new sales order transaction activity such as shipments and RMA returns in Oracle Order Management.

Collect Revenue Recognition Information: determines the percentage of recognized or earned revenue related to invoiced sales order shipment lines in Oracle Receivables.

Generate COGS Recognition Events: creates and costs COGS recognition events for new sales order shipments/returns and changes in revenue recognition and credits for invoiced sales order shipment lines.

After Running ABove Programs, Verify "Material Transaction" Form. A non-physical transaction has been generated Transaction Type= COGS Recognition

Click on "Distributions" Button and verify Accounts.

Deffered COGS : Credit

COGS : Debit.

SETUP > Inventory Resp > Setup > Organization > Parameters > Other Accounts

Here Enter Deferred COGS Account

STEP:

==========

1. Create Sales Order and do Pick Confirm

2. Complete Shipping Confirm Process and run interface trip stop Program.

Below two Accounts Will hit.

Cr > Inventory Valuation accoun

Dr > Deferred COGS Accoun

Go To Inventory responsibility and Review the Accounts in Material Transactions form.

3. Run Workflow Background Process and AutoInvoice Master Program to Create Invoice in AR.

Now AR invoice Got Created, But Revenue not yet Recognized.

Go To AR Resp > Control > Accounting And Search with Sales Order Number.

Revenue Not Yet Recognized.

4. Recognize the revenue in AR.

NAV > Accounts Receivables Resp > Control > Run "Revenue Recognition" Program.

After running the program, again check for Revenue.

5. Now we have to accept the Revenue.

Click on "Manage Revenue".

6. Run Below Set Of Concurrent Programs.

Record Order Management Transactions: records new sales order transaction activity such as shipments and RMA returns in Oracle Order Management.

Collect Revenue Recognition Information: determines the percentage of recognized or earned revenue related to invoiced sales order shipment lines in Oracle Receivables.

Generate COGS Recognition Events: creates and costs COGS recognition events for new sales order shipments/returns and changes in revenue recognition and credits for invoiced sales order shipment lines.

After Running ABove Programs, Verify "Material Transaction" Form. A non-physical transaction has been generated Transaction Type= COGS Recognition

Click on "Distributions" Button and verify Accounts.

Deffered COGS : Credit

COGS : Debit.

Hi,

ReplyDeleteIs COGS relates to depletion of stock ?

You Mean Company Stock Price, Yes it well effect Stock.

DeleteNice doc and nicely made..Appreciated

ReplyDeleteits very nice doc for understanding the concept

ReplyDeleteWhat would be the business scenerio of Deffered CoGS and COGS

ReplyDeleteThose guidelines additionally worked to become a good way to recognize that other people online have the identical fervor like mine to grasp a great deal more around this condition. and I could assume you are an expert on this subject. Same as your blog i found another one Oracle Fusion Cloud Technical .Actually I was looking for the same information on internet for Oracle Fusion Cloud Technical and came across your blog. I am impressed by the information that you have on this blog. Thanks a million and please keep up the gratifying work.

ReplyDeleteThanks for sharing this blog. The content is beneficial and useful. Very informative post. Visit here to learn more about Data Warehousing companies and Data analytics Companies. I am impressed by the information that you have on this blog. Thanks once more for all the details.Visit here for Top Big Data Companies.

ReplyDelete